ZIM rejects $2.4 billion take-private bid from its own CEO

Board launches strategic review after turning down Glickman and Ungar’s proposal to delist the shipping line from the NYSE.

Israeli shipping company ZIM has rejected an offer to acquire the company at a $2.4 billion valuation. ZIM announced on Tuesday that it has formed a team to examine strategic alternatives regarding the company’s future.

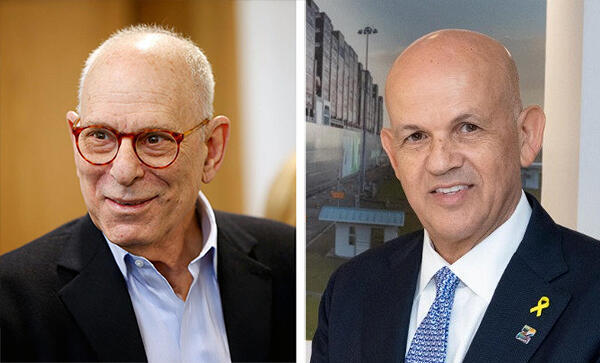

The move followed a non-binding offer submitted by ZIM CEO Eli Glickman and Rami Ungar, Kia’s importer to Israel, to purchase all of the company’s shares and delist it from the New York Stock Exchange. The offer was submitted a few months ago but was officially disclosed for the first time on Tuesday. The partnership between the two, as well as their intention to make an offer, was first reported by Calcalist.

However, according to people familiar with the matter, ZIM’s board of directors, chaired by Yair Seroussi, rejected the offer from Glickman and Ungar.

ZIM shares jumped by over 10% on the New York Stock Exchange. The company currently trades at a valuation of $2.3 billion.

ZIM currently holds around $2.8 billion in cash, but also carries $5.7 billion in liabilities, including $1.23 billion in short-term debt.

Related articles:

ZIM is subject to Israel’s golden share provisions, requiring a majority-Israeli board, an Israeli chairman, and a fleet of 11 ships available for state use in emergencies. While such terms could dissuade foreign buyers, for a global shipping company they represent only a minor restriction.

The story will continue to be updated with the latest news.