Intel facing tough times as layoffs and reforms begin

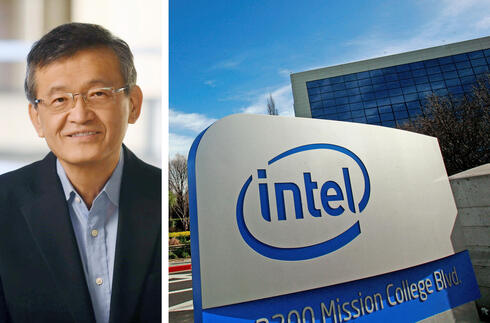

Lip-Bu Tan’s internal letter lays out deep structural shifts, new in-office mandates, and a return to engineering-first culture.

Intel’s long-awaited transformation has officially begun—and its new CEO isn’t sugarcoating what comes next.

Intel employees left in the dark amid talk of radical transformation

Intel cancels Intel Capital spinoff as Lip-Bu Tan shifts to financial discipline

In a letter sent to employees on Thursday, Lip-Bu Tan warned that the company is no longer in a position of strength and must “confront our challenges head-on and take swift actions to get back on track.”

Earlier this week, Bloomberg reported that Intel plans to lay off more than 20,000 employees, or roughly 20% of its global workforce. The company did not confirm specific figures in its quarterly earnings call Thursday, but said it will begin “streamlining the organization, eliminating management layers and enabling faster decision-making.”

Intel, which employs around 109,000 people globally, would be executing the largest round of cuts in its history. While the full impact on individual business units is not yet clear, the downsizing is widely seen as part of Tan’s attempt to rebuild Intel as a leaner, more engineering-driven company after years of strategic missteps and missed opportunities.

“As I have said, this starts by revamping our culture,” Tan wrote. “The feedback I have received from our customers and many of you has been consistent. We are seen as too slow, too complex and too set in our ways — and we need to change.”

Tan’s letter was sent shortly after Intel posted a mixed earnings report. First-quarter revenue came in at $12.67 billion, slightly above analyst expectations. But its forecast for the second quarter—$11.2 billion to $12.4 billion—missed Wall Street estimates and sent shares down more than 7% in after-hours trading.

For a CEO entering his first full quarter on the job, it was a sobering debut. But Tan, who stepped in following Pat Gelsinger’s abrupt departure in December, is leaning hard into change. He is reducing Intel’s operating expense target for 2025 to $17 billion and cutting capital expenditures to $18 billion from the previously planned $20 billion.

In his letter, Tan outlined a sweeping set of cultural and structural reforms. He called for an end to Intel teams that are “eight or more layers deep,” arguing that team size has too often been equated with managerial success.

Related articles:

He added that "There is no way around the fact that these critical changes will reduce the size of our workforce. As I said when I joined, we need to make some very hard decisions to put our company on a solid footing for the future. This will begin in Q2 and we will move as quickly as possible over the next several months."

He also criticized the time employees spend on “on internal administrative work that does not move our business forward,” and promised to eliminate low-value administrative work, unnecessary meetings, and redundant reporting.

One of the most concrete changes coming this year is to Intel’s hybrid work policy. Starting September 1, employees will be required to return to the office four days a week. While Intel’s current policy calls for three days of on-site work, Tan acknowledged that enforcement has been inconsistent. "When we spend time together in person, it fosters more engaging and productive discussion and debate. It drives better and faster decision-making. And it strengthens our connection with colleagues."

The shakeup comes at a precarious time. Intel’s ambitions to become a contract chip manufacturer have strained its balance sheet. Meanwhile, the company continues to lose ground in the AI and data center markets to Nvidia and AMD. The company has also been hit by geopolitical shocks: China, Intel’s largest market in 2024, is threatening tariffs of up to 85% on U.S.-made chips in response to trade actions from Washington.

Still, Intel may see some temporary relief. Global PC shipments rose 9.4% in the first quarter as manufacturers accelerated orders ahead of potential tariffs. And despite flat revenue growth, Intel did exceed expectations on key earnings metrics in Q1, a modest sign of stability amid broader uncertainty.

But it’s clear that Tan is not waiting for markets or politics to stabilize. His strategy hinges on speed, simplification, and a return to Intel’s engineering roots. "Intel was once widely seen as the world’s most innovative company. There’s no reason we can’t get back there, so long as we drive the changes needed to improve," he said. "It’s going to be hard. It will require painful decisions. But we will make them knowing it’s what we must do to serve our customers better as we build a new Intel for the future – and I have great confidence in the power of our team and our people to make it happen."