From Mobileye to Mellanox: Mapping $40 billion in Israeli chip exits

A decade of deals shows how Israel became central to the world’s semiconductor supply chain.

Israel’s semiconductor industry has long punched above its weight. A new report from Startup Nation Central, released on Tuesday, outlines how the country has become a global force in chip innovation through what it calls the “Two-Engine Paradox”: the coexistence of multinational R&D hubs and a compact but highly productive startup sector.

The study, Israel’s Semiconductor Landscape 2025, maps a $40 billion trail of mergers and acquisitions since 1996 and an ecosystem that continues to attract $400-500 million in private funding annually. Yet it also exposes a growing tension, how to maintain Israel’s role as the world’s chip design laboratory without relying too heavily on foreign ownership.

“Our engineers design the chips that power AI, cloud infrastructure, and defense systems,” said Avi Hasson, CEO of Startup Nation Central. “The next step is to grow companies that scale independently rather than sell early.”

The report details how Israeli R&D teams underpin some of the world’s most advanced computing architectures, from Intel’s Gaudi AI processors to Amazon’s Graviton CPUs and Nvidia’s high-speed data center interconnects.

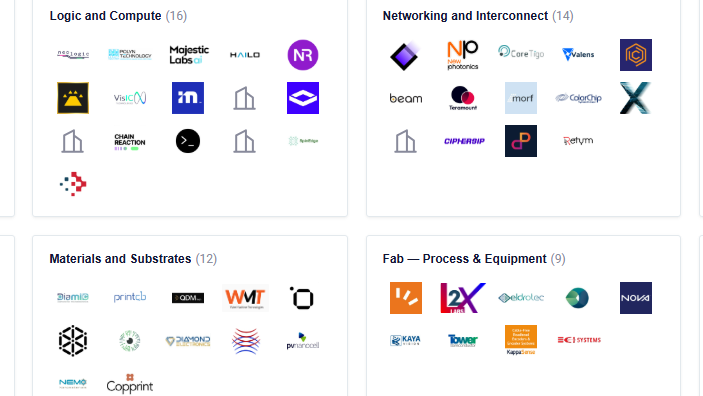

Israel’s semiconductor ecosystem now counts over 250 active companies, roughly 3.5% of the nation’s tech landscape. Employment in the sector has reached 45,000, around 9% of Israel’s tech workforce, anchored by multinationals such as Intel, with 9,300 local employees, and Nvidia, with 5,500.

Related articles:

While the number of firms has grown 16% in a decade, the report says the ecosystem is entering a phase of consolidation. Activity is shifting from the rapid expansion of the 2010s toward steady, capital-intensive scaling.

Despite a cooling global investment climate, semiconductor funding in Israel has remained relatively stable. After peaking at $1.2 billion in 2021, annual private investment has held steady between $400 million and $500 million. Median round sizes now reach $35 million, two to four times the national average, fueled by major deals like Quantum Machines’ $170 million round and Retym’s $75 million raise.

That stability stands out in global context. For every $5 invested in U.S. semiconductor startups, $1 flows to Israeli firms, a 1:5 ratio far stronger than the broader 1:15 ratio between Israeli and U.S. venture capital activity.

The report identifies a structural challenge at the heart of this success. Israel’s semiconductor boom has been built largely on integration with global giants, Intel, Nvidia, Amazon, Apple, and others, all of which have expanded local operations and acquired homegrown firms.

But this deep integration, while lucrative, may be inhibiting the rise of large independent chipmakers. That evolution may prove crucial as the global semiconductor supply chain reorganizes around AI acceleration and geopolitical resilience. Israel’s ability to maintain its edge in R&D while developing scalable, independent firms will determine whether its “Two-Engine” model remains a strength, or becomes a constraint.

cape. Employment in the sector has reached 45,000, around 9% of Israel’s tech workforce, anchored by multinationals such as Intel, with 9,300 local employees, and Nvidia, with 5,500.Related articles:

While the number of firms has grown 16% in a decade, the report says the ecosystem is entering a phase of consolidation. Activity is shifting from the rapid expansion of the 2010s toward steady, capital-intensive scaling.

Despite a cooling global investment climate, semiconductor funding in Israel has remained relatively stable. After peaking at $1.2 billion in 2021, annual private investment has held steady between $400 million and $500 million. Median round sizes now reach $35 million, two to four times the national average, fueled by major deals like Quantum Machines’ $170 million round and Retym’s $75 million raise.

That stability stands out in global context. For every $5 invested in U.S. semiconductor startups, $1 flows to Israeli firms, a 1:5 ratio far stronger than the broader 1:15 ratio between Israeli and U.S. venture capital activity.

The report identifies a structural challenge at the heart of this success. Israel’s semiconductor boom has been built largely on integration with global giants, Intel, Nvidia, Amazon, Apple, and others, all of which have expanded local operations and acquired homegrown firms.

But this deep integration, while lucrative, may be inhibiting the rise of large independent chipmakers. That evolution may prove crucial as the global semiconductor supply chain reorganizes around AI acceleration and geopolitical resilience. Israel’s ability to maintain its edge in R&D while developing scalable, independent firms will determine whether its “Two-Engine” model remains a strength, or becomes a constraint.