Expert

Ridesharing and Pharmaceutical Companies Are More Alike Than You Think

Ridesharing companies promote autonomous and electrified fleets by spending billions on attracting loyal customers; Life-science companies yield zero revenue and burn millions until treatment safety and efficacy are proved

For daily updates, subscribe to our newsletter by clicking here.

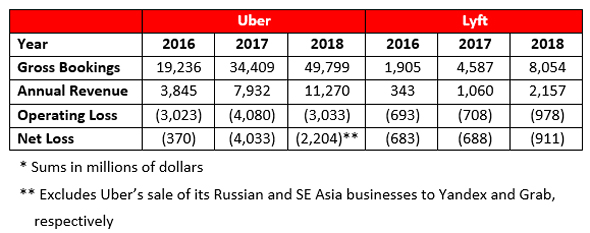

Ridesharing companies bring autonomous and electrified fleets closer to becoming a reality by spending billions on attracting loyal customers and OEM partners. Today, revenue comprises 25% of their gross bookings, but with those fleets it will be closer to 100%.

Life-science companies yield zero revenue and burn millions until treatment safety and efficacy are proved. Small biotech companies stay in the red for years, while big pharma will offset losses incurred from new drug development by continuing to sell the current gold standard. Ridesharing mirrors big pharma by monetizing off the current human-operated automotive standard with profitability reliant upon autonomous and electrified ride-sharing.

The importance of the driverless vehicle is self-evident in the prospect of earning 100% of gross bookings. Electrification, however, is important for a different reason. The potential revenue leap is contingent upon covering costs borne by the drivers being automated: fuel, maintenance, vehicles, accessories, etc. Drivers report fuel as their highest expense, so electrification, provided an adequate provision of infrastructure and stable electricity prices, will significantly reduce costs. A hatchback costs $0.18 per kilometer to fuel, but only $0.02 per km to charge. So, what is the result? Let’s assume that both companies offered autonomous and electrified ridesharing for the years 2016-18, and consider three scenarios: 1. Costs remain stable: essentially impossible. 2. Costs double: quite possible. If fleets are purchased, depreciation will be high, though significantly offset by energy savings from electrification. The scale of operation in cities with high labor costs in R&D, cyber, electrical infrastructure, etc. would also increase costs. 3. Costs tripling: a very highball estimate, but realistic if the companies rent their fleets. For the most probable of these three scenarios (costs doubling) both companies are profitable for every reporting year (aside from Lyft posting a 2016 loss of $167 million). If costs triple, our highball estimate, Uber still manages to post an impressive profit of $6.9 billion in 2018. Such potential revenue increases and relative cost reductions (we didn’t even mention driver welfare, driver commissions, driver insurance, and so on) raises the possibility of erasing cost to the consumer entirely. Future shared, autonomous, and electrified fleets can monetize like software companies. Waymo, the autonomous vehicle unit spun out of Google, has clocked the most autonomous miles and is already offering pilot rides. As the world’s number one advertiser, Google could integrate into ride-sharing apps and screens inside vehicles.Related stories

Daniel Grunstein is an MSc student by research at the University of Oxford and a business analyst at JPMorgan’s Israel Innovation & Technology Centre. Tiran Rothman holds a Ph.D. in behavioral finance from the University of Haifa, is dean of the School of Business and Economics at Wizo Academic College Haifa, and head of Frost & Sullivan, Israel.

The views expressed in this article are the personal opinions of the authors and should not be considered as financial investment advice.

No Comments Add Comment