Analysis

Israel's Banking Ecosystem Is Experiencing Upheaval

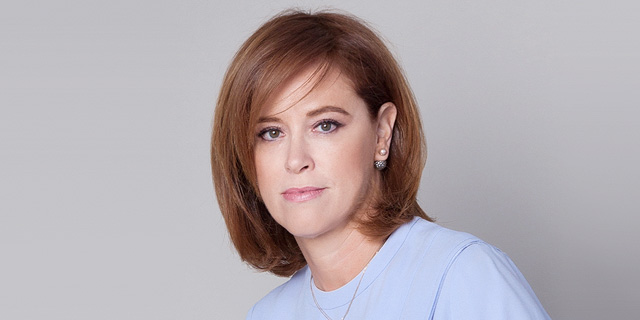

On Sunday, Israel’s Bank Leumi CEO and President Rakefet Russak-Aminoach announced her upcoming retirement, becoming the third Israeli bank CEO to do so since April

Raheli Bindman | 13:23, 01.07.19

When Rakefet Russak-Aminoach, exiting president and CEO of Israel’s Bank Leumi, announced her retirement on Sunday after seven years on the Job, it did not send shockwaves throughout Israel’s financial sector. Russak-Aminoach is the third leading executive to announce retirement in recent months. In April, Bank Hapoalim's CEO Arik Pinto announced his retirement after three and a half years. Last month, Lilach Asher-Topilsky, the CEO of Israel Discount Bank Ltd. since 2014, also announced her retirement.

For daily updates, subscribe to our newsletter by clicking here.

In her announcement, Russak-Aminoach said her decision to make her retirement known months before its actual date was due to her desire to separate her resolution from the identity of Leumi's new chairman of the board, announced later that day. The new chairman, Samer Haj-Yehia, will be in charge of appointing Russak-Aminoach's replacement. But one cannot separate the recent retirement spree from a law passed by the Israeli parliament in March 2016, which set a NIS 3.5 million (approximately $980,000) cap for the annual salary senior executives in Israel's financial sector could draw. Since the law was passed, Israel's banks have lost many mid-level executives and division heads to the private sector, among them Ittai Ben-Zeev, the current head of the Tel Aviv Stock Exchange, who served as the head of Leumi’s capital markets division until early 2017, and Yaakov (Koby) Haber, head of Leumi’s corporate and commercial division until mid-2018, now the CEO of Direct Insurance Company Ltd. Asher-Topilsky, who will step down at the end of the year, has already announced she will be joining Israeli private equity firm FIMI Opportunity Funds. Previous estimates in the market were that Russak-Aminoach, who was expected to announce her retirement at the end of the year, was already receiving offers from international banks. Last month, Calcalist approached Russak-Aminoach after receiving a tip that she has been approached by Morgan Stanley to head its digital division, which she denied. On Sunday, Calcalist reported that Russak-Aminoach is in talks to join Israeli cybersecurity think tank and startup foundry Team8 LLC. Team8 declined to comment. Putting aside the salary limitations, Russak-Aminoach's recent years at the bank were not free of problems. She, along with other key players in Israel's financial sector, was targeted by a local activist group since 2014. The campaign, which included protests and harassment, culminated in various legal accusations against the protestors and a settlement reached in May 2019. In 2018, Russak-Aminoach was also one of several senior executives, along with Pinto, who were required to appear in parliament as part of an investigation into the ease with which Israeli banks afforded bank bailouts to tycoons. In the past, Israel's banks were known to tap new management from within, often with the retiring CEOs themselves singling out an heir. The market is pointing to Chanan Fridman, Leumi's head of strategy and regulatory affairs division, as Russak-Aminoach's choice. But the Bank of Israel's banking supervision division is now demanding a more regulated process, especially considering that three of Israel's five listed banks are currently traded without a controlling shareholder.

2 Comments Add Comment