Interview

"We will need another bubble to get to the valuations we had last year"

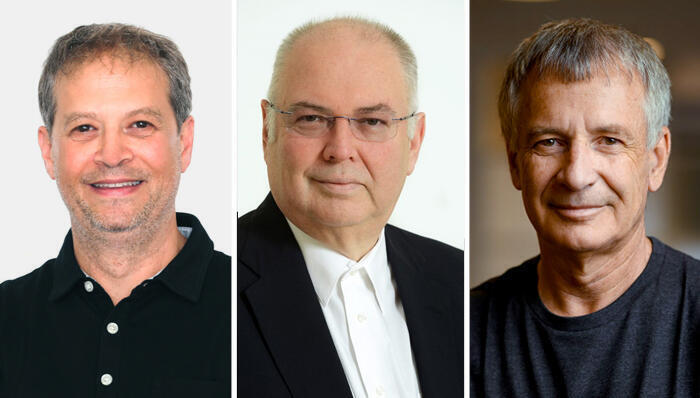

In an in-depth Q&A, CTech picked the brains of angel investor and Salto co-founder Benny Schnaider, serial entrepreneur and Kissterra’s chairman of the board Reuven Ben Menachem, and Atera CEO and founder Gil Pekelman, to gain perspective on the current crisis and where it's headed

Being in the midst of a global crisis, many questions arise. For example, how does the current crisis compare to those of the years 2000 and 2008? Which sectors have suffered the most? Have we reached rock bottom? Are better days ahead?

These questions and more were the subject of a recent in-depth CTech Q&A with a trio of Israel’s leading investors and entrepreneurs: Benny Schnaider, Reuven Ben Menachem, and Gil Pekelman, who aimed to provide some perspective - and optimism - during these troubling times.

A serial entrepreneur and angel investor, Benny Schnaider is a co-founder at Salto Labs. Previously he served as a VP SW at Oracle and before that, he was a co-founder and the chairman and president at Ravello Systems, until it was acquired by Oracle in 2016. Reuven Ben Menachem, chairman of the board at Kissterra, is also the founder and former CEO of Fundtech, a leading global provider of software to the financial services sector. Ben Menachem led Fundtech to a successful IPO in 1998 and raised $100 million in a secondary offering in 1999. Gil Pekelman is the CEO and co-founder of Atera, an all-in-one platform that helps IT professionals from around the world upgrade their work and take it to the next level. Previously he held senior positions both at Indigo NV, now a division of HP, and Exanet, which was acquired by Dell.

Looking back, which crisis was more similar to the current crisis, 2000 or 2008?

“From my personal experience, I believe the current crisis is more similar to the 2000 crisis, because in 2000 it was the burst of the dot-com bubble, and the current crisis marks the burst of the coronavirus cash injection,” said Ben-Menachem. “The crisis in 2008 was related to the MBS crash that created liquidity issues in the market, which was related to the weaknesses in banks’ balance sheets that created an outflow of funds to the market.”

“I believe it is probably a combination of elements from both,” said Schnaider. “In the year 2000, the effect was primarily in the high-tech sector. Many of the high-tech companies had an unsustainable business model that was fueled by overly optimistic public markets. In 2008, it was a more global crisis, across the board. There was a real systemic risk to the global financial system. Now in 2022, the crisis is broader, covering many market segments. But, so far, the systemic risk is limited. Many of the technology companies are healthy, raised a lot of money and their VCs have enough money in their committed capital to survive the crisis. Thus, the impact should be shorter and less widespread.”

Pekelman echoed Schnaider’s response. “The crisis we are currently experiencing shares characteristics from both the ones in 2000 and 2008,” Pekelman said. “In fact, it is a delicate dance between the issues from the latter — namely financial and monetary issues and the former — namely a gold rush for investment. What we are now seeing is a combination of both, which will ultimately correct the market.”

Do you believe we reached the bottom? How long could the recovery take?

“No, we have not reached the bottom yet,” said Schnaider. “It will probably take 1.5 - 2 years to reach the very bottom. Recovery is a relative term. We will need another bubble to get to the multipliers and valuations we had in Q3/2021. Such bubbles occur every 8-12 years. But if you are referring to recovery as return to healthy multiples and reasonable valuations, it will take about 1-1.5 years.”

Ben-Menachem agreed with Schnaider’s assessment and timeline, “We haven’t hit rock bottom yet,” he said. “I believe that we’ll see numerous waves of drops in share prices and company valuations, for the next 18 months or so. Once inflation pressures will decrease, the market will probably start its way toward recovery.”

Pekelman had a different response. “I am going to approach this from a very pragmatic standpoint,” he said. “The fact of the matter is, nobody actually knows. What I can tell you is that at Atera, we are envisioning and planning for the next 2 to 3 years to be more difficult. That said, we are also very confident that our product is necessary, creates efficiencies, and perhaps most importantly, cost-saving.”

How connected is Israel to the developments in the U.S.? In what areas does Israel get dragged behind them and what are the strengths of our local ecosystem that help protect it?

Ben Menachem: “The way I see it, the Israeli high-tech ecosystem is very much connected to the U.S. since a lot of the investments are coming from American VCs. The U.S. market is still the main market for Israeli technology. But as opposed to U.S. based companies that are mostly aiming at their local market, most Israeli companies don’t have a local market, thus they are more diversified with the international markets and with their international sales strategy than those U.S. based companies.”

Schnaider: “Israel is very connected. Israel is typically 1-2 quarters behind the U.S. - for good as well as bad news. The U.S. High-Tech crisis started about 4 months before we felt it over here in Israel. VCs were still paying the higher valuations for local Israeli companies about 3-4 months after the U.S. companies valuations became more conservative in late 2021 early 2022.

"Israel is a very small country with well connected caring people. Israeli managers have a hard time laying-off people. U.S. companies adjust staff faster and more efficiently.

"The biggest strength of the Israeli ecosystem is the fact that we are focusing on deep-tech and on innovation. As proven in the past, our local ecosystem has the agility and ability to adjust to changes, especially during bad times. One example is the cancellation of the Lavi project back in 1987 which resulted in major layoffs and engineers unemployment. But together with the massive immigration from Russia, and government programs and investment created the bigbang of the Israeli High-Tech as we know it today. This is obviously an extreme example, the Israeli ecosystem excelled in other crises since. Nassim Taleb called such an ecosystem - Antifragile."

Pekelman: “Currently nothing about the recent developments in the U.S. is clear-cut. It serves us no great purpose to speculate so let's stick to the facts. The Israel and the U.S.’ tech industries are both intrinsically tied to each other — there are a lot of U.S. investors here, so therefore, whatever happens in the U.S. immediately has a ripple effect here.

"Firstly, what we’re currently seeing is that investors are being more careful with how they invest, and in addition their valuations have gone down, mirroring valuations in the U.S.

"Secondly, the U.S. represents a huge market for Israel, which means that if we were to enter a recession, there would be repercussions in Israel, but it would not be something so cut and dry as it would heavily depend on the specific company and of course, the type of product.”

Related articles:

Which sectors are going to suffer the most in the current crisis?

Schnaider: “Mainly B2C solutions that are relying on massive media purchasing. In other words, companies that rely on expensive traffic purchasing to market and sell their products. Especially those that have a long way to prove their unit of econmy (Customer Acquisition Cost is significantly bigger than the corresponding Live Time Value of the customer base). The Ad Tech, Productivity and gaming sectors are more exposed."

Ben Menachem: "In the last couple of years, we have seen prosperity in companies that were affected positively from the coronavirus (like online services and shopping). As the market is starting its way back to normality we’ll see customers and consumers going back to the normal pre-corona market behavior, which might affect those companies’ volume of business.

"The coronavirus has changed human behavior to the extreme, fading out of it will create a balance between the old ways things were done, and current behavior. For some of these companies, the corona wrongly suggested that growth can be infinite, but since that is not the case, nature has its way to balance things back to normal."

Pekelman: "The fact is that money and higher valuations are going to startups that are still in their early stages. Put simply — for the smaller players, there is still a lot of money to be had. However, things change when it concerns larger companies. Their investors are more conservative, careful, and timid when it comes to handing out money. Why? They have no idea when the stock market is going to stabilize — We’re currently in a state of limbo, but time will tell."

Who can leverage this period to their benefit and how? (companies, entrepreneurs, and investors)

Schnaider: “As Winston Churchill once said “Never let a good crisis go to waste.” As far as companies go, this is the time to make the important but not urgent changes and adjustments. These are adjustments we tend to postpone because of a sea of short-term urgent challenges.

"If you are an entrepreneur, you must ask yourself what has really changed for the long-run? How can I leverage the change? How does the new world affect my business, customers and competition?

"And my advice to Investors is to take more time to analyze and decide on new investments. There is less pressure from cross-over funds and from “outside-money” to close deals at all costs. Take a closer look at your portfolio and prioritize (rank order) your assets. Make sure you have enough reserve for the good companies and divest from the others. Force your CEOs to “think differently” and present to you how they are leveraging the crisis.”

Ben Menachem: "At the current time, the investors can benefit better than anyone else, since they can invest at much lower valuations than before, and they can invest in promising companies that have cash flow issues at almost nothing.

"Stable and profitable companies can benefit from this situation by recruiting talent that no longer sees value in his current equity and is much more willing to move on to more promising and stable companies, the same talent that wasn't available in the high market."

What sectors and/or international markets present investment opportunities at this time?

Ben Menachem: "Early-stage companies and companies that don’t have revenues yet are finding it harder and almost impossible to raise capital. Strong companies that can demonstrate profitable growth, which means that their customer acquisition costs are lower than their customer lifetime value, will still be able to raise capital even at the current market condition."

Schnaider: "Mainly late stage companies who raised a lot of money and have built a DNA and culture based on a very high expense rate but don't have a sustainable profitable business model. Such companies will have a hard time raising money unless they adjust their culture and change their business model. It can be very painful and will cause a loss of employees that are used to and expect the “good old days.”

Pekelman: "The fact remains that tech companies who provide products that create efficiency and digital transformation for their users coupled with disruptive cost-saving prices, will thrive in challenging times such as these."

Will the crisis/recession help in solving the manpower shortage in Israeli high-tech? If so, how? If not, why not?

Schnaider: "No! There is a chronic shortage of people in the Israeli High-Tech industry. It is similar to the situation with our roads infrastructure. The congestion does not change even when we are adding more roads and more lanes because of the “hidden-demand” from drivers. Today, the manpower shortage is filled by out-sourcing and moving development abroad.

"However, if a hard-core developer thinks they are safe, think again. The High-Tech industry is changing and demanding. As individuals, we have to manage our own career. The skills required for tomorrow are different from those of yesterday. One needs to constantly learn (E.g., new programming language, new development environment, new business model). This is true in general, but even more so around crisis changes."

Ben Menachem: "In the short term, it helps. Long term - the Israeli market is suffering from a chronic shortage in talent and resources, since Israel has become a global lab for most of the global technology giants. I believe that the Israeli government has to get involved by creating more technology institutions and greenhouses that can resolve this chronic shortage."

What are 2-3 pieces of advice you have for companies/entrepreneurs looking to survive the crisis?

Pekelman: "Firstly, as the old adage goes: cash is king. When in a crisis, you’re going to have a hard time raising funds, so whatever you do have already, you need to preserve it for long enough and ride out the storm until the market bounces back and is fully-recovered.

"Secondly, whenever you make any decision, you want to make sure to always ask yourself if you aren’t just creating fluff. Instead, you always need to be creating real and tangible value for your customers, be it through marketing spend to communicate that value or in other ways. You must consider every single decision and make sure everything is laser-focused on creating value.

"Thirdly (and lastly), believe in your product and your company. The simple fact remains that companies that come through to the other side of this will come out stronger and better than ever before.”

Ben Menachem: “It is the best opportunity to create cash preservations at this time and to remain laser-focused on your core business model. Continue to raise funds, even at lower valuations, because it will take time for the market to get back to normality, and you need to survive with cash at hand."

Schnaider: "My advice to companies is to take care of your employees, especially your key-employees. They must be experiencing doubts and concerns. Make sure that they are motivated to stay and carry on with the company till success - probably longer than expected. Leaders should openly explain how they see the impact of the crisis on the company and what it is doing to adjust. If needed, work with your board to grant new equity and reprice options, if so required.

"Also, remember that this crisis affects everyone: including your competition. If you have enough resources (E.g., money and people), think how you can leverage your position to get ahead of the competition. E.g., you can put more product/sales/marketing resources in strategic initiatives. Also, if you can afford it, acquire companies that can shorten your time to success.

"As for entrepreneurs, the best time to start a company is during a crisis. If you were considering doing something - just do it. For sure, it will be easier to attract good talent."

How do you use this advice in your current activity, or how do you leverage this crisis in your favor?

Schnaider: "At Salto, we raised sufficient funds to carry us for the next 2.5-3 years with worst case assumptions. We managed and behaved prudently, since our inception. We are doubling down on areas in which we have high success potential."

Ben Menachem: "I am helping the current company I am serving as chairman of the board at, Kissterra, by leveraging these times to find new strong talent and new strong technical and management resources, and by finding acquisition targets that are priced attractively due to the crisis."

Pekelman: “Currently we are focusing on cash and fast growth with efficiency. We are also investing in R&D and hiring talented people for different departments across the board to increase the impact, and very real value of our products. And finally, we are also communicating through our marketing the unique and disruptive cost of Atera, and the efficiency of our solution. It so happens that our mission that we are on a bid to reinforce, starting with a new look, is focused on empowering our users and helping them weather out this storm.”