Crypto-Mining Outfit Bitfarms Files Preliminary Prospectus in Ontario

The Tel Aviv-listed company submitted a prospectus to the Ontario Securities Commission on Friday via its Canadian private subsidiary

Lilach Baumer | 12:28, 12.11.18

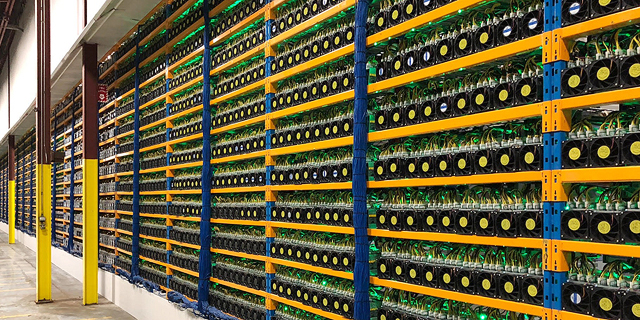

Tel Aviv-listed shelf company turned crypto mining company Blockchain Mining Ltd., renamed as Bitfarms Technologies Ltd. in August and as Bitfarms Ltd. in October, has filed a preliminary prospectus with the Ontario Securities Commission on Friday. The company announced the move in a filing to the Tel Aviv Stock Exchange on Sunday, on the heels of 13 months that saw the company’s stock shoot up by over 6500% and then gradually drop to almost its initial valuation.

For daily updates, subscribe to our newsletter by clicking here.

“Our analysis suggests that Canada has one of the most active public markets in our emerging industry,” CEO Wes Fulford said in a statement.

Bitfarms started its life as an Israeli company registered as Natural Resources Holdings Ltd. After selling its operations and becoming a shelf company, in October 2017 the company announced a pivot to blockchain and a merger with Canadian cryptocurrency mining firm Backbone Hosting Solutions Inc., formed in July that year. The announcement and merger, which came at a time when crypto-related investor hype was at its highest, sent the company's stock up by over thousands of percents within two months. The widespread hype led the Israel Securities Authority to formulate regulations to wall such companies out of its indices, though Bitfarms was ultimately not one of them. Since its December 12 peak, the company dropped by around 95%, reaching the same valuation it held in mid-November 2017. In February, the company announced that Fulford, the intended CEO of Backbone as of March, would replace Bitfarm founder Roy Sebag as CEO following the merger. Sebag stepped down as CEO and board member in April, and Fulford took up the mantle in June. In January, the company announced plans to offer its ADR (American Depositary Receipts) on Nasdaq and to list on the Toronto Stock Exchange by June. The company offered its American Depository Receipt program on OTC Pink, the lowest tier of the three over-the-counter marketplaces, via the Bank of New York Mellon. In July the company announced the termination of the program as it started to trade its ordinary shares on OTCQX, the top tier of the three.

No Comments Add Comment